Can I Claim For Office Furniture . you can claim capital allowances when you buy assets that you keep and use in your business such as cars, printers, computer etc. learn the requirements and limitations for deducting expenses for the business use of your home. — learn how to claim deductions for office furniture and equipment, such as a desk or chair, that you use for work. the benefit of deducting office furniture is that you receive a tax deduction which increases your net income after taxes. Find out if you can claim a. how much can i claim for office supplies and goods? — you can claim office furniture on tax as a limited company or sole trader, as you may qualify for capital allowances on office equipment which reduces taxable profit. The maximum deduction limit for section 179 is $1,080,000 in 2022.

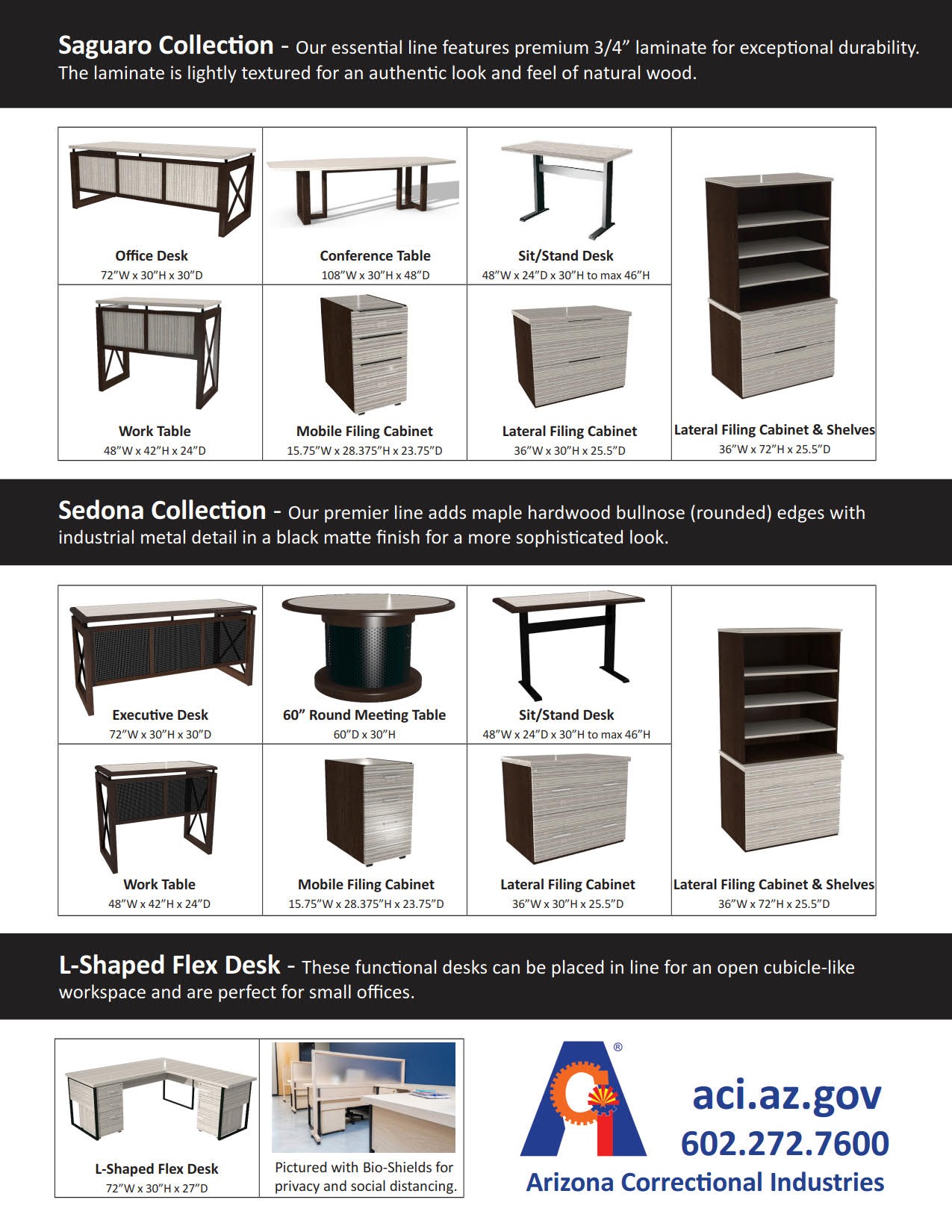

from aci.az.gov

Find out if you can claim a. you can claim capital allowances when you buy assets that you keep and use in your business such as cars, printers, computer etc. — you can claim office furniture on tax as a limited company or sole trader, as you may qualify for capital allowances on office equipment which reduces taxable profit. The maximum deduction limit for section 179 is $1,080,000 in 2022. learn the requirements and limitations for deducting expenses for the business use of your home. the benefit of deducting office furniture is that you receive a tax deduction which increases your net income after taxes. — learn how to claim deductions for office furniture and equipment, such as a desk or chair, that you use for work. how much can i claim for office supplies and goods?

2022 Office Furniture Arizona Correctional Industries

Can I Claim For Office Furniture — learn how to claim deductions for office furniture and equipment, such as a desk or chair, that you use for work. Find out if you can claim a. how much can i claim for office supplies and goods? — you can claim office furniture on tax as a limited company or sole trader, as you may qualify for capital allowances on office equipment which reduces taxable profit. the benefit of deducting office furniture is that you receive a tax deduction which increases your net income after taxes. you can claim capital allowances when you buy assets that you keep and use in your business such as cars, printers, computer etc. learn the requirements and limitations for deducting expenses for the business use of your home. The maximum deduction limit for section 179 is $1,080,000 in 2022. — learn how to claim deductions for office furniture and equipment, such as a desk or chair, that you use for work.

From kintopfurnitureofficefurniture.blogspot.com

How to choose office furniture materials are qualified Can I Claim For Office Furniture the benefit of deducting office furniture is that you receive a tax deduction which increases your net income after taxes. — learn how to claim deductions for office furniture and equipment, such as a desk or chair, that you use for work. The maximum deduction limit for section 179 is $1,080,000 in 2022. Find out if you can. Can I Claim For Office Furniture.

From guardsman.co.uk

The Claim Process for Guardsman UK Furniture Protection Plans Can I Claim For Office Furniture the benefit of deducting office furniture is that you receive a tax deduction which increases your net income after taxes. — learn how to claim deductions for office furniture and equipment, such as a desk or chair, that you use for work. The maximum deduction limit for section 179 is $1,080,000 in 2022. Find out if you can. Can I Claim For Office Furniture.

From milled.com

Epic Office Furniture Claim An Immediate Tax Reduction On Office Can I Claim For Office Furniture learn the requirements and limitations for deducting expenses for the business use of your home. — learn how to claim deductions for office furniture and equipment, such as a desk or chair, that you use for work. you can claim capital allowances when you buy assets that you keep and use in your business such as cars,. Can I Claim For Office Furniture.

From officefurnituredealsblog.blogspot.com

Prepping Your Space for New Office Furniture in 3 Simple Steps Can I Claim For Office Furniture Find out if you can claim a. you can claim capital allowances when you buy assets that you keep and use in your business such as cars, printers, computer etc. learn the requirements and limitations for deducting expenses for the business use of your home. — you can claim office furniture on tax as a limited company. Can I Claim For Office Furniture.

From vantage-accounting.co.uk

How much can I claim for my home as an office • Vantage Accounting Can I Claim For Office Furniture — learn how to claim deductions for office furniture and equipment, such as a desk or chair, that you use for work. The maximum deduction limit for section 179 is $1,080,000 in 2022. the benefit of deducting office furniture is that you receive a tax deduction which increases your net income after taxes. you can claim capital. Can I Claim For Office Furniture.

From epicofficefurniture.com.au

Can I Claim Office Furniture on My Taxes? What You Need to Know Can I Claim For Office Furniture — you can claim office furniture on tax as a limited company or sole trader, as you may qualify for capital allowances on office equipment which reduces taxable profit. the benefit of deducting office furniture is that you receive a tax deduction which increases your net income after taxes. learn the requirements and limitations for deducting expenses. Can I Claim For Office Furniture.

From epicofficefurniture.com.au

Can I Claim Office Furniture on My Taxes? What You Need to Know Can I Claim For Office Furniture Find out if you can claim a. you can claim capital allowances when you buy assets that you keep and use in your business such as cars, printers, computer etc. The maximum deduction limit for section 179 is $1,080,000 in 2022. — you can claim office furniture on tax as a limited company or sole trader, as you. Can I Claim For Office Furniture.

From interioravenue.net

Navigating Business Needs, Choices, and Challenges for Office Furniture Can I Claim For Office Furniture how much can i claim for office supplies and goods? learn the requirements and limitations for deducting expenses for the business use of your home. you can claim capital allowances when you buy assets that you keep and use in your business such as cars, printers, computer etc. — learn how to claim deductions for office. Can I Claim For Office Furniture.

From exolsoask.blob.core.windows.net

Mike's Office Furniture Kingston New York at Phyllis McCloud blog Can I Claim For Office Furniture how much can i claim for office supplies and goods? you can claim capital allowances when you buy assets that you keep and use in your business such as cars, printers, computer etc. the benefit of deducting office furniture is that you receive a tax deduction which increases your net income after taxes. The maximum deduction limit. Can I Claim For Office Furniture.

From www.jasonl.com.au

Can I Claim Tax Back on Furniture for a Home Office? Can I Claim For Office Furniture you can claim capital allowances when you buy assets that you keep and use in your business such as cars, printers, computer etc. The maximum deduction limit for section 179 is $1,080,000 in 2022. — you can claim office furniture on tax as a limited company or sole trader, as you may qualify for capital allowances on office. Can I Claim For Office Furniture.

From www.spaceist.co.uk

Can you claim tax relief on office furniture? Spaceist Can I Claim For Office Furniture — you can claim office furniture on tax as a limited company or sole trader, as you may qualify for capital allowances on office equipment which reduces taxable profit. you can claim capital allowances when you buy assets that you keep and use in your business such as cars, printers, computer etc. the benefit of deducting office. Can I Claim For Office Furniture.

From shunshelter.com

Maximize Your Remote Work Comfort A Guide To Claiming Office Furniture Can I Claim For Office Furniture how much can i claim for office supplies and goods? Find out if you can claim a. you can claim capital allowances when you buy assets that you keep and use in your business such as cars, printers, computer etc. The maximum deduction limit for section 179 is $1,080,000 in 2022. the benefit of deducting office furniture. Can I Claim For Office Furniture.

From mydecorative.com

Tips on How to Take Care and Maintain Office Furniture and Fixtures Can I Claim For Office Furniture how much can i claim for office supplies and goods? The maximum deduction limit for section 179 is $1,080,000 in 2022. learn the requirements and limitations for deducting expenses for the business use of your home. the benefit of deducting office furniture is that you receive a tax deduction which increases your net income after taxes. . Can I Claim For Office Furniture.

From kts.co.nz

Claims for new furniture, office equipment and KTS Can I Claim For Office Furniture the benefit of deducting office furniture is that you receive a tax deduction which increases your net income after taxes. learn the requirements and limitations for deducting expenses for the business use of your home. — you can claim office furniture on tax as a limited company or sole trader, as you may qualify for capital allowances. Can I Claim For Office Furniture.

From www.dailylifedocs.com

12 FREE Claim Letter Examples Can I Claim For Office Furniture Find out if you can claim a. The maximum deduction limit for section 179 is $1,080,000 in 2022. the benefit of deducting office furniture is that you receive a tax deduction which increases your net income after taxes. you can claim capital allowances when you buy assets that you keep and use in your business such as cars,. Can I Claim For Office Furniture.

From kintopfurnitureofficefurniture.blogspot.com

How to disassemble and move office furniture in the new office Can I Claim For Office Furniture you can claim capital allowances when you buy assets that you keep and use in your business such as cars, printers, computer etc. the benefit of deducting office furniture is that you receive a tax deduction which increases your net income after taxes. Find out if you can claim a. learn the requirements and limitations for deducting. Can I Claim For Office Furniture.

From www.officefurniturewarehouse.co.nz

Can I claim home office furniture? Office Furniture Warehouse Can I Claim For Office Furniture learn the requirements and limitations for deducting expenses for the business use of your home. The maximum deduction limit for section 179 is $1,080,000 in 2022. how much can i claim for office supplies and goods? the benefit of deducting office furniture is that you receive a tax deduction which increases your net income after taxes. . Can I Claim For Office Furniture.

From smallbusinessowneradvice.co.uk

How to Claim Office Furniture on Tax (Deductible Scenarios) Can I Claim For Office Furniture — learn how to claim deductions for office furniture and equipment, such as a desk or chair, that you use for work. learn the requirements and limitations for deducting expenses for the business use of your home. — you can claim office furniture on tax as a limited company or sole trader, as you may qualify for. Can I Claim For Office Furniture.